NetSuite Experts for Private Equity Firms

From preparing compliant financial statements to managing investment funds for liquidity, our team of CPAs and controllers can handle every aspect of private equity accounting.

How We Empower Your Business

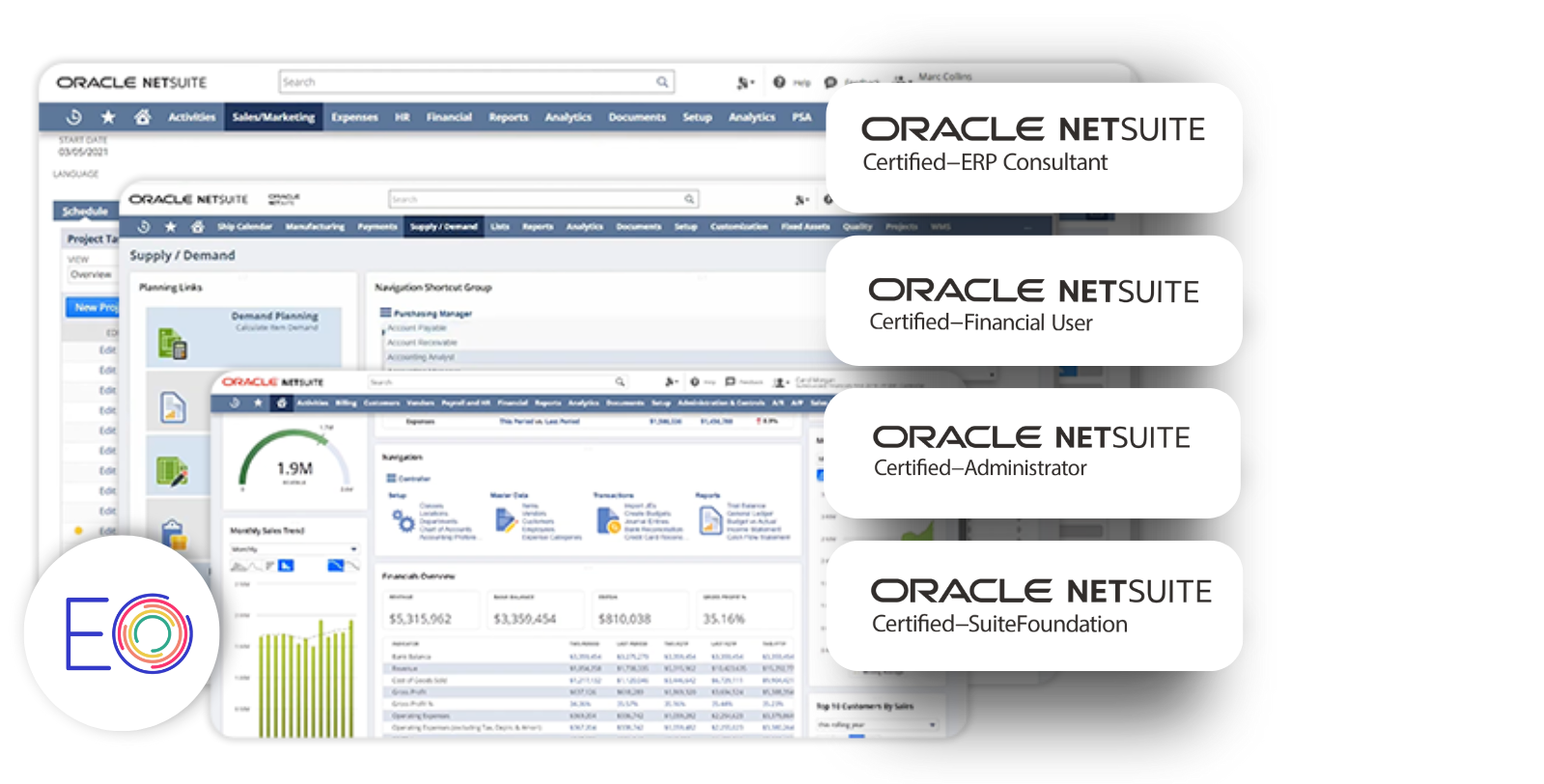

As certified NetSuite partners, we help you leverage the software for precise accounting to optimize your tax position and meet regulatory requirements specific to private equities.

We offer the following essential services to help you take control of your accounting and turn your data into actionable insights:

Data Migration and Optimization

Our CPAs can help you with data review, cleanup and migration from various sources to ensure seamless consolidation of portfolio data. We also provide ongoing support and maintenance to help you maximize NetSuite's capabilities for accurate reporting.

Customization

We integrate specialized tools, streamline processes and create bespoke dashboards to drive investment success for your private equity business. Our goal is to give you a competitive edge within your industry.

NetSuite Controller Services

Not only does our team provide ongoing NetSuite support, but our controllers are fully equipped to manage your daily financial operations. We offer expert oversight to ensure your ledgers are accurate, compliant, and aligned with industry standards.

This includes:

Preparing financial statements for accurate reporting

Adjusting entries for accurate period-end closing and insights

Conducting monthly reconciliations and accounting clean-ups

Overseeing cash flow management and budgeting

Analyzing financial data for strategic decision-making

Maintaining internal controls to prevent fraud and ensure transparency

Coordinating external audits for compliance

Our industry-specific expertise also gives you access to the following benefits:

Due diligence for acquisitions

Profit & loss as well as equity allocation strategies

Cost segregation analysis

Tracking of 1031 exchanges

Tax strategies for Opportunity Zone Funds

Costing and profitability analysis

Working closely with your investment groups and other advisors (lawyers, bankers, etc.)

Project management and accounting software solutions

Frequently Asked Questions

Navigating real-estate accounting and operations can become a full-time job, especially if your agency is expanding. Without a dedicated controller, you are at risk of data discrepancies and non-compliance. Signs your business needs dedicated controller services: You are experiencing rapid growth. Your business is experiencing constant account-related errors or inconsistencies. Top management is getting too involved in accounting-related queries, taking them away from core operations.

With the help of our NetSuite controllers, you can mitigate the risks associated with migrating to different software and make the most of NetSuite’s functionality. This includes: Expertise and knowledge Time and cost savings Scalability and flexibility By outsourcing controller services, you can focus more on core operations without getting bogged down in financial administration.

Our controllers bring specialized knowledge of the regulations that impact private equity firms, from federal SEC requirements to multi-state tax obligations. We help ensure that your financial processes meet a broad range of compliance standards. Additionally, we continuously monitor regulatory changes to keep your firm fully compliant at all times.

No! While our team will help you with financial management, and maintain oversight, you still have ultimate control of your finances. Consider us a partner to your internal team.

Yes. Our clients feature large and small businesses, across a number of industries. This means we can offer flexible services tailored to your business.